The Affordable Care Act (ACA), signed into law in 2010, was enacted to increase the quality and affordability of health care and lower the rate of uninsured by expanding private and public health insurance. One mechanism the ACA established to achieve this goal was the creation of health insurance “Exchanges” – regulated online marketplaces where individuals and small businesses can purchase Qualified Health Plans (QHPs) that provide minimum essential coverage at specified actuarial values. Depending on their income, individuals purchasing QHPs on an Exchange may qualify for reduced cost sharing and premium subsidies in the form of tax credits, making the plans affordable.

As a result of the Exchange QHP tax subsidies, some people may find that coverage under the ACA appears to be a more attractive option than Medicare. Those who currently have QHPs may believe they want to keep their plans rather than transition to Medicare. Others who are enrolled or otherwise eligible for Medicare may also wish to drop their coverage in favor of a QHP. Thus, given that historically most people have transitioned from employer-sponsored plans to Medicare rather than from QHPs to Medicare, the advent of Exchanges has spawned new transition of coverage issues and questions.

Discussed below are common transition of coverage situations and their associated technicalities and consequences. Failing to enroll in Medicare during the established eligibility periods may result in permanent Medicare premium penalties and gaps in coverage due to restrictions on when enrollment can occur. These penalty rules have not been changed to accommodate transitions from QHPs. As such, for the majority of the population, it is generally not beneficial to forgo Medicare coverage in favor of QHPs on the Exchange marketplace.

Currently enrolled in a QHP

Not currently enrolled in a QHP

Currently enrolled in Medicare

Scenario 4 (Most common)

Scenario 1 (Least common)

Eligible for Medicare (but not yet enrolled)

Scenario 3 (More common)

Scenario 2 (Less common)

Detailed Scenario Descriptions

Given that plans in the Exchange are made affordable through tax credits and subsidies however, it may be the case that a Medicare enrollee in this Scenario may find less expensive and better coverage by disenrolling from Medicare and purchasing a QHP. Individuals who must pay a premium for Part A coverage (a small minority of Medicare beneficiaries) are permitted to drop both their Part A and Part B coverage and purchase a plan on the Exchange with tax subsidies. [2] There are potential repercussions to this election, however. First, if an individual chooses to enroll in Medicare at a future date, he or she may have to pay penalties in the form of higher premiums for Part A and B proportionate to the length of time enrollment is deferred. The individual will also be limited to enroll during the general enrollment period and may experience a gap in coverage.

Finally, while the ACA placed underwriting restrictions on charging higher premiums based on preexisting health conditions, insurers are still able to discriminate based on age when they price plans. Consequently, enrollees who are over 65 may find QHPs to be the more expensive option. These factors should highly disincentivize most Medicare beneficiaries from dropping Medicare in favor of a private QHP.

The Social Security Act’s prohibition on duplication of coverage does not apply to those who are eligible for Medicare but have not yet enrolled (i.e. those who have turned 65 but are not yet collecting social security or railroad retirement benefits, those with disabilities or ESRD). [4] Thus, as explained in Scenario 1, an individual may choose to purchase a QHP offered on the Exchange because he or she believes it offers a better value than Medicare. However, the same drawbacks apply; those who are eligible for premium-free Part A coverage will not qualify for the benefits of premium tax credits when purchasing plans on the Exchange. They will also suffer the consequences associated with late enrollment onto Medicare Part B and D. As result, purchasing a QHP in lieu of enrolling in Medicare would not be a prudent choice for most individuals who are eligible for Medicare.

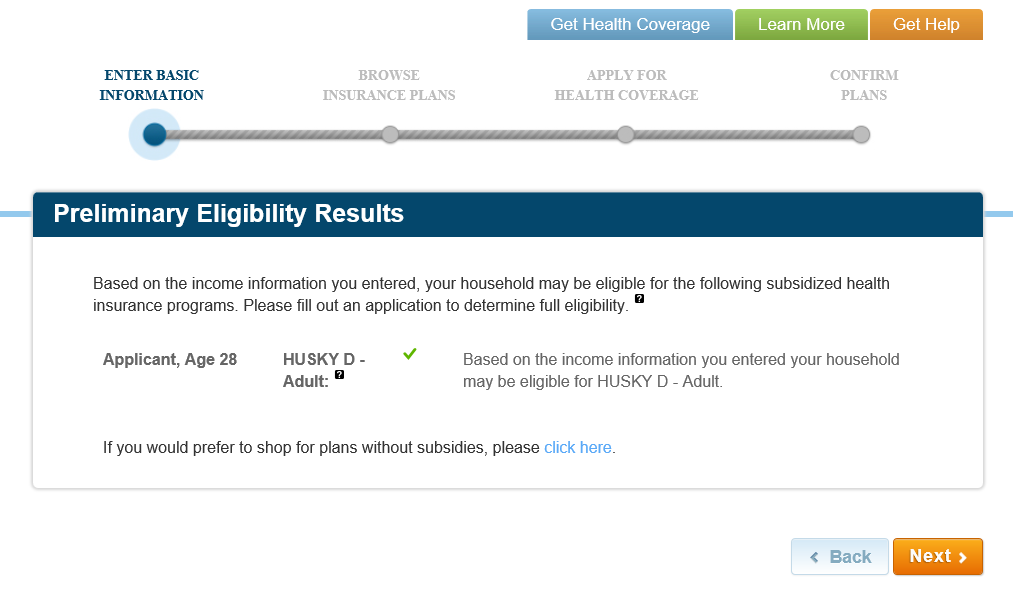

State Exchanges do have the ability to alert people to the fact that they are eligible for Medicaid plans. For example, on Connecticut’s Exchange website, there is a prompt to input age and income in order to view available plans/subsidies. When entering an income that is eligible for Medicaid, the website alerts the individual that he or she may be eligible for a more affordable Medicaid plan before showing any QHP options. An example from the Connecticut Exchange is as follows:

Before the passage of the ACA, people most commonly transitioned to Medicare from employer-sponsored plans. It will grow increasingly common, however, for people to start transitioning into Medicare from an individual QHP purchased on the Exchange. It may be the case that an individual will want to keep their QHP rather than transition to Medicare because of current affordability relative to Medicare.

CMS has recently clarified that in the initial stages of implementing this notice requirement, only those who are dually enrolled in both Medicare and a QHP will receive notices. Those who are only eligible for Medicare will not, for the time being, receive any type of notice that their QHP subsidies will be lost. Therefore, consumers must be diligent in manually terminating their QHP plans promptly upon becoming eligible for premium-free Part A, or risk having to pay back taxes at the end of the year for the subsidies that they continued to receive.

An individual will automatically be enrolled in Medicare Part A and B plans beginning on the first day of the month that they turn 65 if they are eligible to receive benefits from Social Security or the Railroad Retirement Board. [9] An individual, however, will not be automatically disenrolled from their current QHP plan. QHP issuers may not terminate enrollees whom they subsequently find to be enrolled in Medicare without their consent. [10] This applies even if the individual was enrolled in Medicare before enrolling in the QHP.

Conclusion

With the goal of expanding access to quality and affordable health care, the Affordable Care Act has made strides in reducing the number of uninsured through its creation of Exchanges and associated subsidies. At the same time, as a result of ACA, Americans who are eligible or enrolled in Medicare are faced with new decisions as to their source of health care coverage. While the Qualified Health Plans offered on the Exchanges can provide attractive monetary incentives, current and prospective Medicare beneficiaries must choose their source of coverage carefully. Failing to enroll in Medicare during established eligibility periods may result in permanent Medicare premium penalties and gaps in coverage that offset any advantages provided by QHPs. Thus, the majority of the American population should not forego Medicare coverage in favor of QHPs in most circumstances.

September 21, 2016 – A. Roozbehani

[1] 42 U.S.C. 1395ss

[2] Question A6 – https://www.cms.gov/Medicare/Eligibility-and-Enrollment/Medicare-and-the-Marketplace/Downloads/Medicare-Marketplace_Master_FAQ_4-28-16_v2.pdf

[3] Question A8 – https://www.cms.gov/Medicare/Eligibility-and-Enrollment/Medicare-and-the-Marketplace/Downloads/Medicare-Marketplace_Master_FAQ_4-28-16_v2.pdf

[4] Question A3 – https://www.cms.gov/Medicare/Eligibility-and-Enrollment/Medicare-and-the-Marketplace/Downloads/Medicare-Marketplace_Master_FAQ_4-28-16_v2.pdf

[5] http://www.healthcareexchange.com/reformqa?page=58

[6] Question E1 – https://www.cms.gov/Medicare/Eligibility-and-Enrollment/Medicare-and-the-Marketplace/Downloads/Medicare-Marketplace_Master_FAQ_4-28-16_v2.pdf

[7] https://www.gpo.gov/fdsys/pkg/FR-2014-05-27/pdf/2014-11657.pdf (Page 9 of 115)

[8] 45 CFR 155.330(d)(1)(ii)

[9] https://www.medicare.gov/sign-up-change-plans/get-parts-a-and-b/when-how-to-sign-up-for-part-a-and-part-b.html#collapse-3098

[10] Question C7 – https://www.cms.gov/Medicare/Eligibility-and-Enrollment/Medicare-and-the-Marketplace/Downloads/Medicare-Marketplace_Master_FAQ_4-28-16_v2.pdf

[11] Question D1 – https://www.cms.gov/Medicare/Eligibility-and-Enrollment/Medicare-and-the-Marketplace/Downloads/Medicare-Marketplace_Master_FAQ_4-28-16_v2.pdf

Filed Under: Article Tagged With: ACA, Enrollment, Medicare Enrollment, Under-65, Weekly Alert